Planning to rent out a home? Be prepared.

Everyone likes a little extra income, and the "sharing" economy has made that easier than ever. For those with a second property, options like Airbnb and VRBO have become very popular as means of procuring rental revenues. However, renting a home through one of these services can include tax implications of which many are unaware. If you are operating as a landlord for short-term rentals, here are some things you should know.

What qualifies as rental property?

The IRS has a great deal of information on classifying rental properties in Topic Number 415. https://www.irs.gov/taxtopics/tc415

The IRS has a great deal of information on classifying rental properties in Topic Number 415. https://www.irs.gov/taxtopics/tc415

To be considered a rental property, the home in question cannot qualify as a residence. A residence is one in which personal use equals the greater of either 14 days or "10% of the total days you rent it to others at a fair rental price". So what does "personal use" mean, in this case? Personal use can be one of four scenarios.

1. When you or another individual who has an interest in the property (i.e., a business partner or co-owner) uses the property (unless that individual pays you a fair market price for rental). So, if your business partner's family uses the property for a vacation, that's personal use.

2. When a family member uses it without paying a fair price. If you let your niece rent it at half the usual rate while she's in town for the weekend, that's personal use.

3. "Anyone under an agreement that lets you use some other dwelling unit" Consider the rom-com "The Holiday", where Kate Winslet and Cameron Diaz swap houses with each other for a vacation. If you were to do something similar, those days spent at your house would county as personal use, since you were trading them for your own lodgings during that time.

4. Anyone at less than a fair rental price. This is self-explanatory, but also somewhat nebulous. Your best option is to have documentation supporting your pricing strategy, and apply it consistently.

Likewise, any expenses deducted must be deducted proportionally to the amount of time the home served as a rental. (So, if 5% of the year was personal use, only 95% of the appropriate expenses may be deducted.) If the property, in fact, does not meet the criteria to be considered a rental, you cannot deduct expenses on it. However, you also do not have to report rental income, in that case.

What can be deducted?

Expenses that are necessary for "managing, conserving and maintaining your rental property" can be deducted. These could include plumbing repairs, or cleaning services. You can also deduct expenses related to the business of renting out the property, such as any host fees from Airbnb, or advertising and legal fees related to the property.

Expenses that are necessary for "managing, conserving and maintaining your rental property" can be deducted. These could include plumbing repairs, or cleaning services. You can also deduct expenses related to the business of renting out the property, such as any host fees from Airbnb, or advertising and legal fees related to the property.

You can also deduct any expenses which the tenant paid and which you then had to reimburse the tenant for. (For example, if the air conditioner breaks on the weekend, the tenant pays to fix it quickly, and you then reimburse the tenant, you can deduct that repair expense.)

You cannot deduct costs of improvements, those costs incurred in the act of restoring the property, or adapting it for a different use. You can, however, recover some of those costs on Form 4562 where you would report depreciation expenses.

Occupancy Tax

Many states and municipalities require landlords to collect and remit occupancy tax on short-term rentals. (It's a bit like a sales tax, but for hotels.) You will need to closely examine your local laws, as they can vary greatly on tax rates, what constitutes short-term rental, how frequently it must be remitted, etc. To further complicate the matter, occupancy tax may be collected by states, counties, AND cities.

Many states and municipalities require landlords to collect and remit occupancy tax on short-term rentals. (It's a bit like a sales tax, but for hotels.) You will need to closely examine your local laws, as they can vary greatly on tax rates, what constitutes short-term rental, how frequently it must be remitted, etc. To further complicate the matter, occupancy tax may be collected by states, counties, AND cities.

Additional Taxes

If you were to sell your property, after it has been designated as a rental, you will need to report the income from the sale as capital gains, and pay capital gains tax on that accordingly. If you are a high-income earner, you may also be responsible for net investment income tax. (See IRS Topic Number 559.) https://www.irs.gov/taxtopics/tc559

If you were to sell your property, after it has been designated as a rental, you will need to report the income from the sale as capital gains, and pay capital gains tax on that accordingly. If you are a high-income earner, you may also be responsible for net investment income tax. (See IRS Topic Number 559.) https://www.irs.gov/taxtopics/tc559

1099s

As always, be sure that you are collecting W-9s from service vendors and following all applicable requirements for filing 1099s at year-end.

As always, be sure that you are collecting W-9s from service vendors and following all applicable requirements for filing 1099s at year-end.

We work with a number of property owners, on these very issues every day.

When you're not a "startup" anymore...

All of "Hamilton" is great, of course, but, among the multitude of great lines, there's one in particular that always speaks to me as a business owner. During Cabinet Battle #1 (a rapped debate about America's fiscal strategy), Hamilton states to Jefferson, "Thomas, that was a real nice declaration. Welcome to the present; we're running a real nation."

Though the line is directly referring to conflict between the Federalists and Anti-Federalists, it always makes me think of the challenges startups face after they've achieved their first measure of success. You start with your own personal "Declaration of Independence" (from your previous job), start a company, and then just fight to survive. One day you wake up and it's a real business. The question then is, "Now what?"

Speaking from our own experience growing a fast-moving startup over the past five years, I wanted to offer our advice on what to do next when your startup grows up.

Scaling economically.

Ironically, in a lot of ways, it's easy for a startup to be profitable. The staff is small and working like crazy, and no one expects a huge salary or a ton of perks, so you get a lot of bang for your buck out of the few people you have. You probably don't have an office yet (maybe just a co-working space), so there's not that huge monthly expense hanging over your head. The overhead in general is low, and you're really putting your A-game out there for every possible sale.

Ironically, in a lot of ways, it's easy for a startup to be profitable. The staff is small and working like crazy, and no one expects a huge salary or a ton of perks, so you get a lot of bang for your buck out of the few people you have. You probably don't have an office yet (maybe just a co-working space), so there's not that huge monthly expense hanging over your head. The overhead in general is low, and you're really putting your A-game out there for every possible sale.

Sure, it's not sustainable in the long-term (unless you are cool with regular nervous breakdowns), but in those early days you can often at least break-even, even if you're not rolling in the dough.

Eventually, you realize that your staff does need to grow, or that you do need a place everyone can work centrally. (Though you have to be careful not to add those costs just because they're things you want. See our prior article, Living a Lie: The mistakes that make entrepreneurs go broke.)

Scaling is not without its risks, but there are steps you can take to mitigate those risks. Having a budget is key, obviously, but it is also helpful to map out conditional budgets for if you add various expenses, such as rent (or if you were to have a slow sales month). You can use those to establish a set point for when you're willing to add to your overhead. (For example, once we are regularly at x recurring revenue, we will sign a lease on an office, or hire support staff.) This can allow you to scale at a safe pace, without over-expansion.

Managing changing stresses.

When a startup is new, your main stressor is where the next sale is coming from. As the business grows and acquires clients in greater numbers, some of those stressors go away, and new stressors are added.

When a startup is new, your main stressor is where the next sale is coming from. As the business grows and acquires clients in greater numbers, some of those stressors go away, and new stressors are added.

One of the biggest headaches in a growing company stems from managing a growing staff. When the company is small, you're operating in your area of expertise. As the company grows, you have to learn more about being a leader. Hiring and managing employees can take a mental toll, especially as you realize that the systems that worked when the company was smaller are no longer sufficient. (For instance, you will likely need to invest in a CRM that can help your new staff navigate their workload. Even if the original startup members don't need it, new employees will.)

Additionally, as you get more and larger clients, the clients themselves will require additional management. It can be hard to deliver the same level of personal attention when your time is spread so thin between them. It will become necessary to delegate some of the customer service duties to other staff (terrifying as that may be).

This is not to say you drop contact with clients, or aren't available when they need something; it just means you unload some of those duties onto other people, so the client can get what they need (even if they're no longer getting it directly from you).

Becoming who you are supposed to be.

It's not uncommon to feel a bit "lost" as your company grows. I experienced a small existential crisis the first time we signed and began work with a new client with whom I myself had never directly communicated. Once I got over the brief panic that I might no longer be needed, I realized how freeing it was, that I knew we could bring in revenue without my involvement. As we grew and hired additional staff, I didn't have to work on every single account; a new admin meant that I didn't have to manage the filing and calendar anymore.

It's not uncommon to feel a bit "lost" as your company grows. I experienced a small existential crisis the first time we signed and began work with a new client with whom I myself had never directly communicated. Once I got over the brief panic that I might no longer be needed, I realized how freeing it was, that I knew we could bring in revenue without my involvement. As we grew and hired additional staff, I didn't have to work on every single account; a new admin meant that I didn't have to manage the filing and calendar anymore.

I began to have something almost resembling "free time", and for me, that was terrifying. I had to figure out what to do with myself.

Fortunately, I really enjoy the study of business, in general. I began focusing on how we could improve processes, expand into new markets, and stay ahead of changing trends. I worked for us to become one of the first Xero-certified partners in our area, and began focusing on new business types (B-Corps, for example), so we could be prepared to serve upcoming businesses.

I also started focusing on who I wanted to be as a business leader, and who we wanted to be as a company. In a lot of ways, the company's growth has freed us to circle back to those original goals and mission statement. It's not enough just to grow a successful business; we want to stay in line with why the company was founded in the first place.

It's easy to imagine what you think a business owner should look like (see our article What makes an owner? for some prime examples) and fall into the trap of backing too far off from the company, or becoming an absentee owner. This is not what embracing your changing role means. It means that, instead of ordering business cards, you're calling referral partners (not that you're relaxing on a yacht while the minions do all the work).

It seems ironic that success should bring so many difficulties, but adapting to those new challenges is what sets companies apart. Be flexible, stay committed, and plan for everything you can, and you'll keep the fire you started growing strong.

Guest Post: Neal Isaacs, "Advice on Accountants (for what it's worth)"

Today's guest post is from Neal Isaacs. Neal Isaacs, MBA, CBI is a Business Broker and the owner of VR Business Brokers of the Triangle, located in Raleigh, NC. He writes about business and helps business owners discover their exit options. Call (919) 628-0571 or email [email protected] for your free consultation. Learn more at http://www.vrbiztriangle.com/.

Today's guest post is from Neal Isaacs. Neal Isaacs, MBA, CBI is a Business Broker and the owner of VR Business Brokers of the Triangle, located in Raleigh, NC. He writes about business and helps business owners discover their exit options. Call (919) 628-0571 or email [email protected] for your free consultation. Learn more at http://www.vrbiztriangle.com/.

As a business broker, I answer a lot of questions about how to sell a business. One of my FAQs that I share with all business owners planning to sell is about the total cost to sell a business.

People don’t think about costs in selling a business. The first question people always think is “How much can I get?” but the truth is:

It’s not how much you make, but how much you keep that matters.

So how much will you keep? What will be left depends on how much it costs to sell a business, as well as your tax treatment on what you get. Costs to sell a business, if you don’t consider paying off your debts, are primarily professional fees. Consider the investment in a business broker, as most business sellers are doing it for the first time, and the sale of a business is a complicated and convoluted transaction, and consider the costs of a business attorney.

sell a business, if you don’t consider paying off your debts, are primarily professional fees. Consider the investment in a business broker, as most business sellers are doing it for the first time, and the sale of a business is a complicated and convoluted transaction, and consider the costs of a business attorney.

You’ll also want to consider the costs of a accountant. Chances are sellers are already using these advisors, but there may be some additional costs for updating or adjusting P&L statements.

Depending on your time frame for the sale of your business, there may be more that can be done from an accounting perspective to increase the value of your business from a buyer’s perspective. Let’s consider:

How Far?

The “look-back” period for the sale of a business is normally three years, but some buyers will ask for five. If you’re planning to sell your business in the next couple of years, it’s wise to communicate this fact to your accountant, and to start working with a business broker. Preparing and highlighting the best financial aspects of your business is something a good business broker can help you with in conjunction with your accountant.

The fact of the matter is, running a business to sell is different than running a business to support a lifestyle. The IRS has a lot of rules that your accountant will know and guide you on regarding how much you’ll have to pay in taxes, but a good accountant will also know how to protect you from paying too much tax in a legal and ethical manner.

How Much?

It may sound obvious, but don’t be afraid to ask an accountant how much they charge, or at least to give you a range of what to expect. Different accountants charge different prices for similar work because they have different costs to run their businesses, and they bring different experience to each opportunity, so interview your prospective accountant to learn if they are bringing the right skill and experiential sets that you need.

Do We Fit?

When picking an accountant, it’s good to ask them about what their client base looks like. You’re accountant will know exactly how much money you have, and the size of your business eventually, so consider being up front with them in your first meeting if for no other reason than to ask them if your business resembles their current book of business. If your business is an outlier, they may simply not be reviewing the tax code and regulations related to the needs of your business.

Too Much?

I have seen one person pay $400/hour for financial due diligence on a deal for buyer representation, and it was way too much. The CPA on the buyer’s side was more than willing to ask questions and go down paths that were not germane to the deal at hand, in part because he was being paid by the hour, and in part because his client hired him to investigate, and he was used to investigating very complicated businesses. This was not a complicated business, and in my opinion this buyer brought a cannon to a knife fight (and paid for it).

Whether you’re a buyer or a seller, picking the right accountant, or even upgrading to the right accountant, can pay for itself. Especially after the sale, when you have to deal with the financial repercussions of capital gains (this is another great question to ask your accountant early if you’re a seller).

If you need help choosing or interviewing an accountant in preparing for the sale of your business, I can help. Email me at [email protected] and I’m happy to share some questions that you could ask an accountant that you’re considering hiring.

Feature Spotlight: Davidson Wicker, CEO of Ravetree

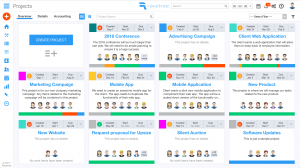

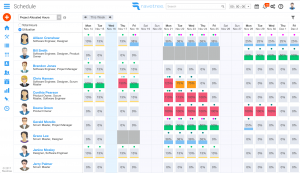

As those of you who have known us over the last few years are aware, The Bookkeeper grew quickly. When new employees were brought on board, it became obvious that our old, piecemeal system of digital file storage in one location, a time tracking app in another, and endless emails detailing project updates, would not be sufficient as we scaled.

We were fortunate to come across Ravetree in its early days, and to have the opportunity to adopt it to our business. It has been a true "game-changer" for us, and has really allowed us to stay on top of all of our client and operational needs, even during rapid expansion.

I got to ask Ravetree CEO Davidson Wicker a few questions about himself, his company, and their product.

Courtney: I saw that your educational background is in Applied Physics. How did you transition that into a career in software development?

Davidson: I taught physics for a couple of years as I was building up my coding skills. We did some scientific programming in grad school, so that's where I started to get a taste of how fun programming could be.

Local Entrepreneur Spotlight: An Interview with Dave Baldwin of Baldwin Management Consultants

Courtney recently sat down with Dave Baldwin, of Baldwin Management Consultants, in Raleigh. From his website: "Dave Baldwin is an experienced marketer and self-taught entrepreneur who first went into business for himself in 2007 after ten years in the technical field, spurred on by a desire to help introverted entrepreneurs succeed in business. Dave has worked with clients in a variety of different industries."

Courtney recently sat down with Dave Baldwin, of Baldwin Management Consultants, in Raleigh. From his website: "Dave Baldwin is an experienced marketer and self-taught entrepreneur who first went into business for himself in 2007 after ten years in the technical field, spurred on by a desire to help introverted entrepreneurs succeed in business. Dave has worked with clients in a variety of different industries."

Courtney: I can't start without asking about "Let's Not Have Coffee". Why do you think that piece has become so popular so quickly?

My other skill set is marketing copywriting, which is mostly a matter of speaking the customer's language. That's not easy, but I've developed some simple methods for uncovering what's important to customers. It starts with asking the right questions, and I've been told I have a gift for that. Being a consultant is not about telling someone what to do. It's about helping a client create a solution that they feel good about. Most people already have most of the knowledge they need to solve their own problems, but they just haven't looked at their situation from the right vantage point. A good marketing message should help them see things in a new way.

In addition to being an established local entrepreneur, Dave is one of the breakout speakers at the upcoming Triangle Small Business Summit, sponsored by Affordable Promos and The Bookkeeper. Dave will be speaking on Using Technology and Automation to Grow Your Small Business.

Guest Post: "What Does Marketing Strategy Have to do with Bookkeeping?" by Haley Lynn Gray

I have run across more than a few small business owners - some doing okay for themselves, others not - who take the shotgun approach when it comes to marketing their business. The first key is when they tell me that they have “The Facebook”, and they’re doing “ads”, and they are doing a bit of this and a bit of that.

I know that they are likely trying everything they come across, with little regard for the strategy and overall marketing plan. It’s not that I don’t believe in being spontaneous, or even getting creative with part of your marketing. But the reality is that nearly every piece of your marketing should come together; it should all work together, sort of like an orchestra.

If you start running Facebook ads without a solid presence and good organic reach, the cost of your ads is going to be significantly higher, and the cost per client for acquisition is going to be dramatically higher. In some cases, I’ve seen the cost of a lead being 5-10 times the cost that it would be with a good organic strategy.

If you start running Facebook ads without a solid presence and good organic reach, the cost of your ads is going to be significantly higher, and the cost per client for acquisition is going to be dramatically higher. In some cases, I’ve seen the cost of a lead being 5-10 times the cost that it would be with a good organic strategy.

The same concept applies to Google Adwords. The lower your SEO ranking, and the less high quality content you have on your website, the higher your cost will be to advertise with Google Adwords.

I see people who toss up a landing page using Web.com, YP.com or others. Unfortunately, if you take this approach, you might be building links to a website that isn’t your own. It won’t help you get that organic reach for your website and you’re losing control of the process. You’ll also end up spending more money for fewer leads, and thus end up with fewer results.

It’s important to have a strategy with all the pieces coming together. Sometimes the tweaks can be tiny, like adding a clear call to action on every blog post, or making a point of collecting email addresses so that you can stay in touch with people via email campaigns. It takes strategy and planning to collect those email addresses and to execute a well thought-out marketing campaign. By thinking through how all of the pieces should work, and with help from a strategist if you need one, you can end up saving a lot of money.

It’s important to have a strategy with all the pieces coming together. Sometimes the tweaks can be tiny, like adding a clear call to action on every blog post, or making a point of collecting email addresses so that you can stay in touch with people via email campaigns. It takes strategy and planning to collect those email addresses and to execute a well thought-out marketing campaign. By thinking through how all of the pieces should work, and with help from a strategist if you need one, you can end up saving a lot of money.

Every business needs a strategy and a budget. So does a marketing plan. Everything should be measured, and data should be collected on how your system is performing so that it can be tweaked and improved. Do these steps for every aspect of your business and you will see savings and a healthier bottom line.

Haley Lynn Gray is CEO and Founder of Leadership Girl, a digital marketing agency, where she uses her skills as a sales and marketing strategist and social media expert to help small business owners grow their business.She combines her years of real-life and business experiences with her MBA from Duke’s Fuqua School of Business to benefit her clients. Haley works with them closely to set goals and put processes in place so they can achieve and exceed their goals.

Haley, along with her team, can also help with social media management, website updates, drip campaign management, and all aspects of business marketing.

In addition to running her business, Haley is a mom of four, a Girl Scout Leader and an author of two best-selling books. Haley is truly passionate about helping entrepreneurs achieve their potential, and empowers them to overcome obstacles in entrepreneurial ventures. www.leadershipgirl.com

Raising a Business from a Puppy

This past weekend, after months of my boys wearing me down, we went to the animal shelter and adopted a puppy. And not just any puppy, but a hound/terrier mix that is estimated to reach 65 pounds at adulthood. After a lifetime of owning tiny dogs (mostly Pomeranians), I knew Charlie would be a new adventure.

As we have been adapting to a puppy-friendly house, I have been thinking about how similar raising a puppy is to growing a business. There are similar challenges, but similar strategies to face them, as well.

Hav e set rules.

e set rules.

The first thing I did was to set ground rules early on, before the puppy had even set foot in the house. I reminded my sons that he was never to be fed people food, not allowed on the furniture, and that allowing him to roughhouse and "play-bite" was a bad idea.

In a business, it's also easier to practice good habits early on, and to avoid the bad ones. Getting into the practice of having separation of duties and staying on top of bookkeeping is easier when your business is small, and sets you up for success as your company grows.

Protect your assets.

Charlie has a crate he sleeps in and to which he is confined whenever the family isn't home. We have also stressed to the boys the importance of keeping toys and other valuables off the floor and in their rooms, where they are safe from puppy teeth. (I learned the lesson myself, when a laptop cord I'd left next to my desk was chewed through the first day.)

A new business, if not well-protected, can be even more destructive for an owner. Not having the proper insurance or levels of separation can not only be disastrous for the business, but can bankrupt you personally. And since none of those protections can be applied retroactively, it is best to have them early on, before you need them.

Get help from the experts.

I know a lot about animals, but I also know I can't be an expert in every area. We have a veterinarian to help take care of our pets' health. I may be comfortable giving the dog a bath, but I still prefer to take him to a professional groomer for things like a nail trim. And though we are reinforcing training at home, we already have Charlie signed up for puppy training classes. I don't have the time to provide absolutely everything Charlie could need, and there are experts who can offer those services much more efficiently than I ever could.

Businesses also need a lot of help, and it doesn't make sense for the owners to handle everything. Even if you're planning on doing your books yourself, get an expert to help set-up and train your and your staff. If you wait until your business is large to come up with a bookkeeping solution, you'll have an unmanageable beast on your hands.

Guest Post: "The Value of Referral Sources for Your Business" by Haley Lynn Gray

Guest Post: "Accidental Partnership" by Richard Bobholz

“Oops, I tripped,” won’t work too well as an excuse if you find yourself under scrutiny for an accidental partnership. Despite having the potential to be incredibly damaging, these arrangements happen all the time in business.

What is an Accidental Partnership

An accidental partnership is a partnership that was entered into inadvertently. Yeah, I know that didn’t help at all. These commonly occur when two or more businesses get together to try to put on an event, coalition, or joint marketing efforts.

For example: the very first instance I encountered this was very shortly after I began my firm. A colleague approached me and told me all about this great expo that she and a few other colleagues were going to put on, and she wanted to know what risks there were. That’s when I told her about the accidental partnership.

The Law

North Carolina defines a partnership as “an association of two or more persons to carry on as co-owners a business for profit.” Person can mean any individual, company, or association of any type. What constitutes a business for profit is very broadly interpreted and includes any activity where profit was desired, not necessarily achieved.

In the example above, it was actually a partnership of LLCs that was getting together to put on the expo. Since the expo was to be separate from each of their businesses and yet not an incorporated or organized entity, we’re looking at a partnership.

What does that mean for the partners?

A partnership is not necessarily a bad thing. Each of the individuals in the partnership would have had personal liability protection because of the nature of their LLCs, so they wouldn’t lose any personally owned property if something went bad. However, under the partnership, every partner is 100% liable for anything that goes wrong. That means that if one partner causes huge damages to an attendee at the expo, any partner could be held liable. The person who was harmed can choose one or all of the LLCs involved in the expo to sue for damages.

Partnerships are defined largely by contract law. This means that the partners can define a lot of the rights and responsibilities of the owners and of the company itself. There are default rules that cannot be contracted away, such as the duty of each partner to act reasonably prudent when acting on behalf of the company.

Unless a contract specifies otherwise, the ownership, profits, and losses are divided equally. Additionally, the liability and management are owned wholly by each partner. That means that each partner may make any decision on behalf of the partnership, and the other partners could be held liable for those decisions. This is a scary position to be in.

How do I protect myself?

First and foremost, being able to recognize these types of situations before you enter into them will provide huge protections. Anytime you join together with another company or individual to conduct anything business related, there’s a good chance you’re looking at a partnership. At that stage, you should think of whether or not you want to be in that partnership. You can always avoid it by removing the ownership components, instead either being a contractor or making the other participants contractors. In those cases, contractors should get paid, and management should only belong to the owners.

The best way to protect yourself if you do go forward with a partnership is two-fold:

- Create a separate entity for the project or business activity you’re doing in conjunction with other businesses. An LLC acts like a partnership and provides that liability shield.

- Create a clear and concise contract between the partners so that in the event something goes wrong, there are terms in place to protect you. This should also define what the rights and responsibilities of each partner is, as well as how to resolve any disputes as they come up.

Richard Bobholz is the Managing Partner at Law++, a revolutionary and award-winning business law firm in Durham, North Carolina. Law++ sets itself apart by offering flat rate pricing, easy to understand retainer packages, and the highest quality customized legal services to all their clients. They were also the first law firm in North Carolina to become B Corporation Certified.

Richard Bobholz is the Managing Partner at Law++, a revolutionary and award-winning business law firm in Durham, North Carolina. Law++ sets itself apart by offering flat rate pricing, easy to understand retainer packages, and the highest quality customized legal services to all their clients. They were also the first law firm in North Carolina to become B Corporation Certified.

Links:

Law Plus Plus – www.lawplusplus.com

Facebook – www.facebook.com/lawplusplus

Twitter – www.twitter.com/lawplusplus

LinkedIn - https://www.linkedin.com/company/law-plus-plus

Check Mark Startup – www.checkmarkstartup.com

Working When Overwhelmed

There will frequently be times in your business when you feel overwhelmed. There will be days or weeks when setbacks pile upon themselves, when everything that can go wrong will go wrong, and all at once. And you'll fall behind.

The danger in being overwhelmed is that it can lead to two disastrous pathways: one in which you're paralyzed into inaction by the seemingly insurmountable mountain of tasks before you, or one where you fall prey to the temptation of "multitasking" and fall to pieces trying to do too much at once.

Fortunately, procrastination and busyness are really two sides of the same evil coin. Today we're going to discuss how to catch up on what you need to do, even when the sky is falling.

Let's examine the Who, When, Where, and How of working when overwhelmed.

Who

This seems obvious enough. You, right? Well, if you have employees, there might be some tasks you can delegate. The trick is to assign appropriate tasks in a manner which does not eat up your time or create more work for you. If an employee is already capable and available to take something off your to-do list, that's great. If you are going to have to expend time and energy in explaining the assignment, it is better, while you are behind, to go ahead and do the task quickly yourself. Training can come later when more time is available.

Also, asking an employee to assume additional or different duties is not a time for the two of you to hold a vent session on how busy and behind you are. It's nice to have someone in the business with whom to commiserate, but that will have to come after you're finally caught up.

When

When

Now! If you are behind on work, start with the first thing on your to-do list and get to it. Don't go make coffee, don't check Facebook "real quick", and don't cultivate your Pandora station. Give yourself little breaks to do those things as rewards for tasks completed. But if you're waiting until everything is "just perfect" to start, you'll never get ahead of the work.

Where

As mentioned before, don't spend too much time getting your environment ideal before you address your to-do list. However, it is imperative that your area be relatively distraction-free. Put your phone on silent; close your office door if you have one. Even if you're in a co-working space, you can put in headphones, or something else that sends the message that you're not available for small talk. Do not have social media tabs open in your browser.

How

Start with taking a quick inventory of everything you need to get done. (No, don't make a complicated, color-coded Excel spreadsheet of your task list. That's just procrastinating with the illusion of working.) Personally, I love the Wunderlist app for keeping to-do lists, as it allows you to make categories and re-order your lists. See what assignments you need to complete first, and what can be put off. (Maybe have a to-do list for today, this week, etc.)

Block off time on your calendar for these tasks. Not only does it help you get in the mindset of, "I am scheduled to work on this, now", it sends a clear message to anyone you work with that you are busy. It particularly helps if you have the sort of business that includes frequent meetings, as it serves as a visual reminder to leave some time for solo work.

Get the first item on your list done as quickly as you can, with no breaks unless absolutely necessary. Check it off your list. Once you have made that first bit of progress, you'll be amazed at how much it motivates you to knock out the next item. Getting a few things out of the way can help you build momentum and feel accomplished. After that, you can battle that "overwhelmed" feeling and start to see that, though you are very busy right now, there is a light at the end of the tunnel and, when you get this backload of work completed, things will calm down for a while.

If work has piled up on you and you're feeling like you'll never be out from under it, try these steps. And stay tuned for our upcoming article on how to get organized and avoid becoming overwhelmed in the first place.