What Does a CFO Do?

If you asked the average person what a CEO does, they can probably give you a fairly detailed answer, somewhere between the truth and the truth as influenced by pop culture. CEOs are visionaries who run companies by giving presentations and going to board meetings.

By contrast, if you ask what a CFO does, the answer you might get is, “Shred documents.” CFOs rarely get famous, and it’s even more rarely for good reasons. But CFOs do serve real, legal, purposes. So we seek today to answer the question: What does a CFO do?

CFO vs. Accounting Manager

It might help to start by clarifying what a CFO does not do. Though a CFO is, by definition, the Chief Financial Officer of a company, their role is not the same of that as an Accounting Manager. An Accounting Manager directs the accounting department and ensures accuracy and timeliness of company financials, as well as making sure the day-to-day accounting operations run smoothly. In contrast, the CFO is responsible for the financial health of the company, as well as leading its financial direction. To put it in simple terms, if the power gets shut off because someone forgot to pay the bill, it’s the Accounting Manager’s fault. If the power gets shut off because the company can’t afford to pay the bill, it’s the CFO’s problem.

How Do Big Companies Use CFOs?

A CFO’s role is to develop and implement the financial strategy of an organization. They not only analyze the present financial position, but develop projections and forecasts for where the company is headed. If an accountant is a historian, the CFO is a futurist.

Beyond analysis of the basic company financials, they develop KPIs to track financial health, and are a key figure in making financial decisions, such as issuance of shares. In publicly-held companies, the CFO also ensures that regulations are being met and obligations to shareholders fulfilled.

What Can a Small Company Do?

What Can a Small Company Do?

Per Salary.com, as of March 29th, 2022 the average CFO in the United States makes $412,529 per year. This is an expense that is not an option for many small-to-midsized businesses. Many small business owners choose to cover those duties solo, though some choose to outsource the work to a fractional CFO.

An outsourced CFO can help with obvious needs, like pursuing financing from lenders or investors, or special reporting required for grants and government contracts. However, they can also help with everything else the big companies get: budgets, pricing strategies, expansion planning, etc. The trick is in finding a good outsourced CFO.

What Makes a Good Outsourced CFO?

What Makes a Good Outsourced CFO?

Projects die when there’s a lack of focus, and that includes financial projects. A good CFO consultant will help determine what CFO services are needed, in what order, and the timeline for their implementation and overlap. (Since the CFO is not a full-time employee, and human capital in a smaller company is more limited as well, it’s impossible to start all projects desired all at once.)

The good CFO will not just assist with the higher-level thought exercises, the analysis of data already collected, but will also help with practical implementation. A company who is outsourcing CFO work may also not yet have an Accounting Manager, and the CFO consultant can help fill in those gaps, and be sure that financial systems are well-developed and running smoothly. Since the CFO cannot provide good analysis without good data, it benefits all for the books to be clean and timely.

Most importantly, a good CFO will exhibit flexibility in working with a client, not trying to sell a set package of services, but developing plans unique to that company’s needs. A sales bonus plan doesn’t necessarily help a company with receivables issues, nor should a company with poor cash-flow focus on immediate expansion. A good CFO will be dynamic, instead of taking a one-size-fits-all approach, and will be honest with the client, even when they don’t want to hear it.

And, of course, they won’t rely on the paper shredder to cover up financial crimes.

"Your Business is Only as Good as Your Accounting System" by Dave Baldwin

This article may be a rude awakening for a number of small businesses. You may bake the best cupcakes, deliver the best massages, or engineer the fastest and most secure computer systems, and still be held back by your accounting system. It's a sad thing when businesses make amazing products or invest years of sweat equity to build a stellar reputation -- only to watch it all crumble because they didn't build a robust financial infrastructure to support it. The cold hard truth is that every business's accounting system (or lack thereof) is ultimately what makes or breaks the business.

What does accounting have to do with your competitive advantage?

The competitive advantage of a business is that which your competitor cannot easily duplicate. In Rule #1, investor Phil Town details the approach by which he follows Warren Buffet's methods for investing in companies. One of the criteria is what he calls "moats," or layers of protection around the proverbial castle that comprises a business. One type of moat is a well-established brand name. Even if a competitor builds a superior product at a lower price, they cannot copy or take away brand recognition. A strong brand does not guarantee success in itself, but it is a key factor in the longevity of a business.

The competitive advantage of a business is that which your competitor cannot easily duplicate. In Rule #1, investor Phil Town details the approach by which he follows Warren Buffet's methods for investing in companies. One of the criteria is what he calls "moats," or layers of protection around the proverbial castle that comprises a business. One type of moat is a well-established brand name. Even if a competitor builds a superior product at a lower price, they cannot copy or take away brand recognition. A strong brand does not guarantee success in itself, but it is a key factor in the longevity of a business.

Now, let's take a look at how management systems play a role in competitive advantage. Let's use a hypothetical example of two marketing agencies. Both agencies have highly creative talent. Both are well-known in their markets. Both work with high-profile clients. Both have a well-established track record for delivering great service. But they diverge in one area: accounting. We'll call them Agency A and Agency B.

Agency A has a basic nuts-and-bolts accounting system. They keep track of their costs, they know how much money they have. They know their cash flow, and they know their break-even point. They know how many client engagements they need per month to cover their overhead expense and taxes. The goal of Agency A's accounting system is to keep the lights on. And it works.

Agency B, on the other hand, looks at accounting differently. They aren't just trying to survive; their goal is to grow. Their goal is to dominate their space and scale their business to twice its current size over the next two years. They have built a system to support their objectives.

Now, let's take a look at the difference between their accounting systems.

Sales, Marketing and Revenue Forecasting

Agency A knows how much revenue they bring in each month. They have a rough estimate of how much they are likely to make for the next six months, based on their recurring monthly revenue from regular clients as well as a few deals in the works that they expect will close soon. They exhibit at a couple of expos each year, and they've found that these usually generate enough business to pay for themselves. They don't feel the need to examine any data, because they know that certain marketing tactics work if you just do them. They don't take clients whose budgets are too small. They will never say no to a client with a big budget, unless they just can't do the work.

Agency A knows how much revenue they bring in each month. They have a rough estimate of how much they are likely to make for the next six months, based on their recurring monthly revenue from regular clients as well as a few deals in the works that they expect will close soon. They exhibit at a couple of expos each year, and they've found that these usually generate enough business to pay for themselves. They don't feel the need to examine any data, because they know that certain marketing tactics work if you just do them. They don't take clients whose budgets are too small. They will never say no to a client with a big budget, unless they just can't do the work.

Agency B knows how much revenue they bring in from each of their major service lines, and they've used their accounting system to determine which types of services are the most consistently profitable. They track their marketing campaigns and sales activity relentlessly, and they pay close attention to how much it costs them to acquire each new customer. They notice where their best customers come from, and how many marketing touches each one required. Based on this data, they constantly fine-tune their campaigns and focus their advertising spending on the most effective marketing channels. They are sometimes surprised at what the data reveal. They are not concerned with how big or how small a client is; only whether the job is profitable and whether the client is a good fit. They take pride in their track record of starting with small clients and helping them grow. They have also walked away from multimillion-dollar accounts when the risk was too high.

Talent Utilization and Capacity

Agency A tracks time spent on client projects with a reasonable degree of accuracy. They have a pretty good sense of how busy everyone is. They are very cautious about hiring, because they've made the mistake in the past of hiring too many people and then needing to let some go when business slowed down. They often use independent contractors and freelancers as a stop-gap measure when large projects come in or when work becomes unusually busy. They like having a flexible work force that can be called on an as-needed basis. Hiring full-time staff is generally a rarity unless someone leaves the company, so they usually do not advertise for new talent. When they do hire, they are often in a hurry to fill the position quickly because it is in reaction to a sudden upswing in work, so they can't be as selective as they would like to be.

Agency A tracks time spent on client projects with a reasonable degree of accuracy. They have a pretty good sense of how busy everyone is. They are very cautious about hiring, because they've made the mistake in the past of hiring too many people and then needing to let some go when business slowed down. They often use independent contractors and freelancers as a stop-gap measure when large projects come in or when work becomes unusually busy. They like having a flexible work force that can be called on an as-needed basis. Hiring full-time staff is generally a rarity unless someone leaves the company, so they usually do not advertise for new talent. When they do hire, they are often in a hurry to fill the position quickly because it is in reaction to a sudden upswing in work, so they can't be as selective as they would like to be.

Agency B is rigorous about utilizing their team's time and talent in the most effective possible way. They have broken down each service line into standard operating procedures, and they have defined benchmarks detailing reasonable time spans for completing tasks. When they notice that tasks are taking longer than usual to accomplish, they investigate to figure out why. Agency B's management carefully watches the team's capacity and is always advertising and interviewing candidates for their next team member. They are always anticipating growth, and they know when to pull the trigger on a new hire based on their sales pipeline and capacity of their current team. They view the next hire as inevitable, and they recognize that finding the right person may take time, so they are always advertising and interviewing whether or not they have an immediate need.

Company Culture

Agency A has a ping pong table and free coffee in their employee lounge. They take pride in having a hard-working team, but also a laid-back office. Employees generally like working there, and the pay and benefits are comparable to the rest of the industry. Communication is good overall, and people have a lot of flexibility to do their jobs in the way that they prefer- as long as the work gets done and the clients are happy. People sometimes work from home, and they enjoy the flexibility to adapt their schedules to the needs of their families, to a reasonable degree. There is no obvious path for advancement at Agency A, but management points out that there's plenty of room to grow for people who take initiative. They've been frustrated a couple of times when their best people left to take jobs in larger firms or to start their own businesses. There have sometimes been grumblings about inconsistencies in pay, but the owners feel that this is not justified.

Agency A has a ping pong table and free coffee in their employee lounge. They take pride in having a hard-working team, but also a laid-back office. Employees generally like working there, and the pay and benefits are comparable to the rest of the industry. Communication is good overall, and people have a lot of flexibility to do their jobs in the way that they prefer- as long as the work gets done and the clients are happy. People sometimes work from home, and they enjoy the flexibility to adapt their schedules to the needs of their families, to a reasonable degree. There is no obvious path for advancement at Agency A, but management points out that there's plenty of room to grow for people who take initiative. They've been frustrated a couple of times when their best people left to take jobs in larger firms or to start their own businesses. There have sometimes been grumblings about inconsistencies in pay, but the owners feel that this is not justified.

Agency B has a no-frills workplace. Everyone discussed the idea of adding perks like a nicer employee cafeteria, but since the company has a generous profit-sharing plan, and everyone feels a sense of ownership in the company, no one wanted to spend the money on extraneous benefits. At Agency B, everyone loves their work. They know their numbers, and everyone is fantastic at what they do. There is never a boring day at Agency B, because they are always taking on new challenges. Since the company is always growing, new opportunities for career growth are always emerging. It is rare that the company makes a bad hire, and when they do, it becomes apparent quickly. The wrong people weed themselves out. There is a sense of friendly competition among the team. People work different schedules, but everyone is dedicated and working hard, and no one doubts it. Because everyone's job is measured against benchmarks, there is never any question as to who is performing and who isn't.

Which agency would you rather work for? Which one would you be more likely to invest in? Which one's services would you be more likely to retain?

Every single competitive advantage listed here, and countless others, all boil down to accounting systems. There is one difference between best-in-class businesses and average businesses, and it all boils down to their accounting systems. As boring as it might sound to some, the accounting system of a business is what creates the clarity and insight to make decisions. Businesses that have imprecise accounting systems tend to make decisions based on feelings, and people tend to perceive feelings as more accurate than they really are.

If you're weighing your options for next year and considering what investment of time and energy will make the biggest difference, the first place to look is your accounting system.

Dave Baldwin is an integral part of The Bookkeeper staff experienced in marketing and management consulting. His own entrepreneurial journey was spurred on by a desire to help introverted entrepreneurs succeed in business.

Accounting Technological Changes: Fear, Abuse, or Embrace?

At my first job (as an accounting intern for a midsized corporation), we ran reports in Excel and did manual daily bank reconciliations. When I got to college, my accounting practice sets were on paper ledgers; it was a thrill to go to my part-time job in a CPA’s office where the original version of QuickBooks Pro was available for me to use. 5 years ago, when I left my job as a Budget Officer with the North Carolina state government, we were finally upgrading our accounting software out of DOS.

Needless to say, I love and appreciate all of the new accounting technologies available today.

However, as the industry changes, so must those of us within it change and improve, or risk being left behind. Firms tend to fall into one of three categories when facing these changes.

Those who fear change.

Sadly, I have found that roughly half of the CPAs and tax preparers with whom I interact are highly resistant to new technologies, with the majority of them refusing to use cloud-based accounting software in any sense. I am frequently told, “I learned on desktop, and that’s what I’m comfortable with.” Having a preference and continuing to use desktop is fine, of course; many businesses are still on desktop accounting solutions, and it is still the best option for many businesses. But by refusing to work with other software packages, these professionals are either a) closing themselves off from a large portion of the market or b) forcing their clients into a solution which might not work best for them.

Sadly, I have found that roughly half of the CPAs and tax preparers with whom I interact are highly resistant to new technologies, with the majority of them refusing to use cloud-based accounting software in any sense. I am frequently told, “I learned on desktop, and that’s what I’m comfortable with.” Having a preference and continuing to use desktop is fine, of course; many businesses are still on desktop accounting solutions, and it is still the best option for many businesses. But by refusing to work with other software packages, these professionals are either a) closing themselves off from a large portion of the market or b) forcing their clients into a solution which might not work best for them.

Cloud-based accounting allows multiple professionals (tax preparer, bookkeeper, and client) to work in the same set of books simultaneously, without the need to transfer a file back-and-forth. It also allows the client to perform some of the lower-level accounting tasks that might be more efficient for them to do (i.e., invoicing), without the need to outsource it and pay more unnecessarily. By refusing to adapt, either due to fear or stubbornness, the accounting professional is doing their client a disservice, and costing them more money. Over time, they will also cost themselves business, as more and more clients move to newer softwares.

Those who abuse change.

Accounting programs have come a long way, but there is still a real need for a high level of professional oversight. Sadly, there has been a push in the accounting world towards “100% automation” and “a business which runs itself”. While the work certainly has gotten easier (or at least, less manual), trusting the machines to do everything, without your involvement, is still a recipe for disaster.

Accounting programs have come a long way, but there is still a real need for a high level of professional oversight. Sadly, there has been a push in the accounting world towards “100% automation” and “a business which runs itself”. While the work certainly has gotten easier (or at least, less manual), trusting the machines to do everything, without your involvement, is still a recipe for disaster.

Take, for example, the integrated bankfeed in QuickBooks Online. This is a very nifty feature that allows bank accounts and credit cards to feed directly into the accounting software and be added from there, greatly speeding things up from the manual entry of days past, and helping to ensure that transactions are not missed. It also has some additional interesting functions, such as machine-learning that allows the software to recognize bank descriptions and default transactions to how they were last entered, and a “rules” feature that allows a user to program certain descriptions to default to certain transactions.

90% of the time it works very well, which is what makes the 10% of the time it doesn’t work so disastrous.

For example, the feature that recognizes and assigns transactions based on the bank’s description of the transaction is a nightmare when it comes to assigning checks. Let’s say you write a check to a subcontractor, and assign it correctly in QuickBooks. The next time a check comes through the bankfeed, it will automatically default to that subcontractor. If the person assigning it is not paying attention, multiple checks can be assigned to one individual or business, throwing off the financials, future 1099s, etc.

Bankfeed rules can cause similar problems, as there is an option to create rules which add transactions to the ledger automatically, bypassing human review. We never use this option at The Bookkeeper, but we have seen companies do so. Again, this can be disastrous on those rare occasions where the computer algorithm makes a mistake.

New technologies can only be trusted to work up to a point; overreliance on them is inexcusable when it results in results in inaccuracies in the financials.

Those who embrace change.

One of the things that makes me very proud of our company is how we have integrated new technologies in ways that better serve our clients, without using them as a substitute for genuine human oversight and customer interaction.

One of the things that makes me very proud of our company is how we have integrated new technologies in ways that better serve our clients, without using them as a substitute for genuine human oversight and customer interaction.

Things like cloud accounting, app integrations, bankfeed rules, and the like have allowed us to serve a greater number of clients more efficiently. It’s also allowed us to work with clients who might not have yet been able to afford a fully outsourced solution, by training them on some of the tasks which have been made easier by improvements in software.

However, we have no fear of being replaced by technology. In fact, new technologies have freed us up from manual tasks so we can focus on the part of the work we really love; working directly with clients on analyzing their financials, examining the market, making plans for improvement, and educating business owners on best courses of action for their companies.

And even as computers get better at aggregating and analyzing data from various sources, they will never be able to replace a human connection. A machine may recognize that retail rent prices are better a zip code over, but we can understand that a client wants their storefront in walking distance of their child’s school. Or, it might make more sense, by the numbers, for a business to adjust hours seasonally, to save money in the slow periods. But a person can recognize when an owner wants to keep his employees at full-time wages, even if it means a little less money in their own pocket. And the more that computers can handle the data entry, or “number-crunching” aspects of our job, the more we can focus on solving these more complicated, human problems.

Technological changes are unavoidable. But from where we sit, that’s not a bad thing.

You Better Reconcile

When we meet with new clients, one of the first things we like to determine is how recently their books have been reconciled to the bank accounts. Sometimes, (rarely), the books have been reconciled to the prior month. Sometimes it's been a few months, or a few years. Sometimes a bank reconciliation has never been performed, and the client's not really even sure what that means.

Since "knowing is half the battle", I'm going to explain what a reconciliation is, the basics of how it's performed, and why it's important.

What's a monthly bank reconciliation?

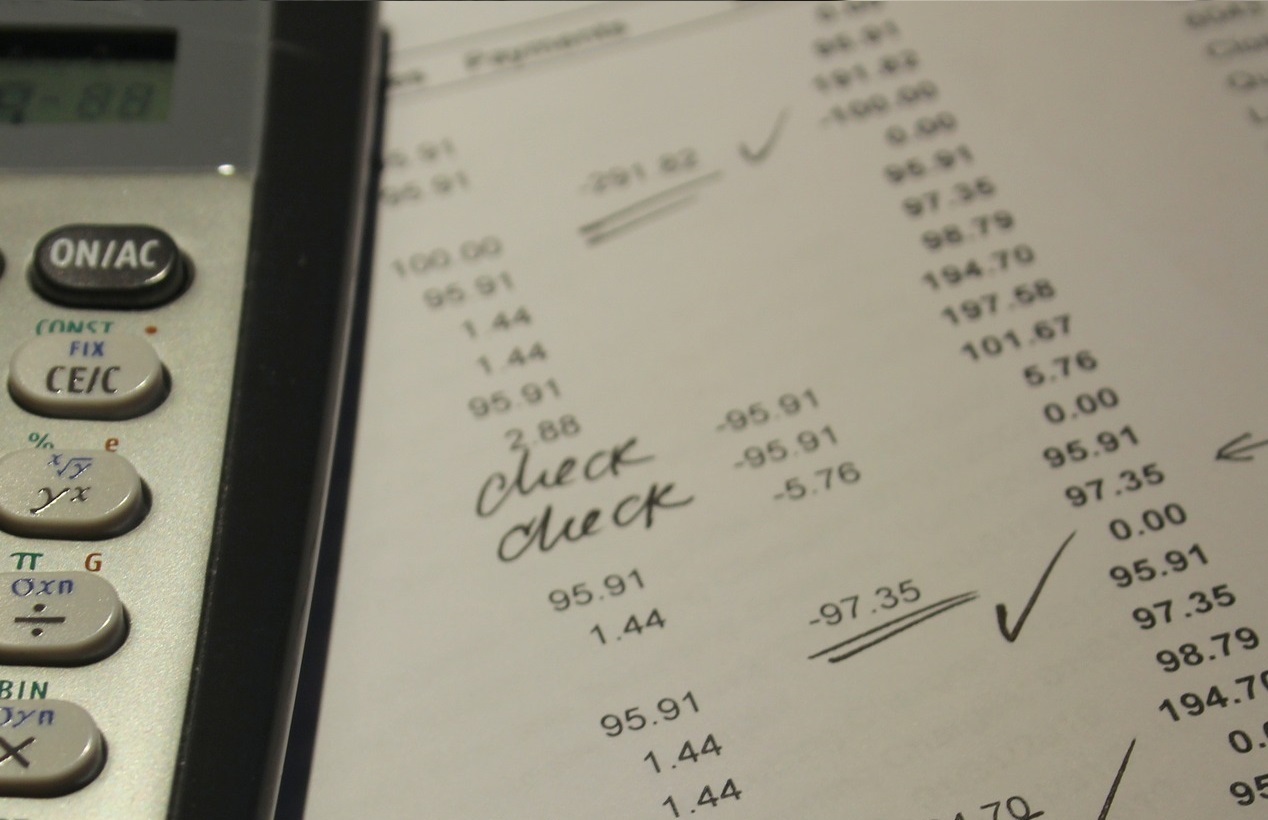

To clarify, there are many types of reconciliations, for bank accounts, credit cards, petty cash, inventory, sub-ledgers, etc. For this article, we're referring to bank reconciliations. A bank reconciliation is like balancing your checkbook, for your business. Most accounting software programs now come with a reconciliation tool (instead of the spreadsheets we used in the days of yore). Since it is the most popular accounting software in small business, I'll be referencing the QuickBooks reconciliation tool.

How is a reconciliation performed?

First, you need to see when the account was most recently reconciled, and then obtain a copy of the bank or credit card statement for the following month. Second, after ensuring that the prior month's ending balance matches the following month's beginning balance, you'll note the statement's ending date and ending balance.

From there, you go line-by-line through that month's transactions, matching each one to its equivalent entry in your accounting software, to make sure that all transactions are properly entered and that your cash balance in the software matches the balance in the bank, for the same ending date.

That sounds very time-consuming and tedious. Why would anyone want to do that?

Monthly bank reconciliations are a very useful tool for ensuring accuracy in your books. They can:

Show you what's missing. Sometimes, transactions do not make it into the books, either because they did not download correctly, or weren't manually entered. If a transaction is on the bank statement but not in the software, you know it needs to be added. Also, sometimes there will be things recorded in the software which aren't on the bank statement. These could be inaccuracies, or it could be something like checks which have not yet cleared the bank. If there's a large number of uncleared checks, it's helpful to know that, for cash-flow purposes.

Show you what's duplicated. If you have a large number of uncleared checks, particularly if some of them are months-old, it could mean that an expense was added without being matched to the written check, and was therefore duplicated. The same thing can happen with income. I once found where a new client's prior-year annual sales were overstated by about $50,000, due to deposits not being matched to previously-recorded payments. The uncleared payments showed up on the reconciliation report, and helped the client avoid overpaying on his taxes.

"Lock down" errors to one period. If your books were accurately reconciled last month, and something is wrong on this month's bank reconciliation, you only have to go through about the last 30 days to find the error. If your books have not been reconciled in a long time, or ever, it's going to be a lot more work to find where the inaccuracy occurred.

Maybe accounting professionals are a little weird, but many of us even find bank reconciliations to be fun (or, at least very satisfying when accurately completed). If you're having trouble with your bank reconciliations, if you need help learning how to perform them, if something looks wrong but you're not sure what, or if you're just sick of doing them and want to pass the job off to someone else, contact us. We happily provide a free 1-hour initial consult to answer your questions.

What to Look for in Hiring a Bookkeeper

As your business grows, you will reach a point where you need to seriously consider hiring a bookkeeper. Unfortunately, bookkeeping is still a very un-regulated industry. Anyone can market his or herself as a bookkeeper, and it can be very difficult to sort the wheat from the chaff.

Obviously, your needs will be very specific to your company. However, there are a few basic things you can look out for to help you make the best decision in hiring a bookkeeper.

Look for certifications AND references.

Some people are very good at test-taking, and can certifications easily in an afternoon. (For instance, some lower-level QuickBooks certifications can be very easy to obtain with a minimal amount of studying.) But if they are difficult to work with, or don't do a great job of taking care of clients' books, they will likely not have many positive references available.

Some bookkeepers are very social and, at least on the surface, can impress clients. (Or, at the very least, they're good at getting friends and family to provide them with references.) However, if they do not have the accounting knowledge and technical skills necessary, they won't be good bookkeepers.

When seeking help, prioritize bookkeepers who have both certifications and a significant amount of references. Beyond client reviews, also look for reviews from partnering businesses, such as CPA firms. A good CPA appreciates working on financials that have been prepared by a good bookkeeper.

You can also ask your potential bookkeeper for references from current or prior clients in a business similar to yours.

Check their business registration.

Most legitimate bookkeeping firms will have officially registered their company. Depending on their state of registry, you can look up such information as how they are structured, how long they have been in business, their company officers, whether they have every faced dissolution, etc. (In North Carolina, where we're based, you can check the Secretary of State website for business registrations.)

There's nothing wrong with hiring a newer company, but you might want to consider a bookkeeping firm which has been in business for a few years, first. You can also look at things like whether they have a physical office space, or if the company ownership has changed hands multiple times. (And if they have been administratively dissolved in the past, consider it a major red flag.)

Heed the red flags.

There's a great quote from the show Bojack Horseman which goes, "When you look at someone through rose-colored glasses, all the red flags just look like flags."

Considering the high importance of your bookkeeping being done accurately, you do not want to ignore any red flags in your search for a bookkeeper. Being slow to respond, having little web presence, or being too eager to jump into working with you can all be red flags. If they are setting off your alarm bells during the initial search, consider how much worse things can become once you have hired them.

Ask about their experience with companies like yours, and with services you might need (such as their systems for managing payroll, sales tax, etc.). Ask about their policies on client communication, and how they prioritize time-sensitive tasks. Most importantly, particularly if they are a 1-person shop, ask about their plans for who can back them up on your account in the event of an emergency, where they might be unexpectedly unavailable.

Make sure THEY ask YOU good questions.

A few months ago, we met a prospective client for a free 1-hour consultation. She was upfront about the fact that she had scheduled interviews with other bookkeepers, and would be following up with us later. A few weeks later she let me know she would like to hire us. Her reason for choosing us, over other companies was, "You actually asked me questions and looked at my system. You were the only one who did that."

Be leery of a bookkeeper who swears they can handle your business financials without first establishing exactly what that entails. Not every client is a good fit for every bookkeeper (and vice versa). We maintain friendly relationships with our local competitors, so we have a good alternative to offer when we meet with a prospect and realize they would not be a good fit for us. Likewise, our competition sends us referrals, as well.

In your initial meeting with your potential bookkeeper, make sure they are trying to learn about your business, and not just sell you on theirs.

Find someone who understands accounting beyond record-keeping.

There is a misconception that a great bookkeeper is just someone with exceptional data entry and organizational skills. However, there is a lot that a real bookkeeper can do to help save money on taxes, identify areas of risk, or even improve profitability. Something as simple as how an owner's cash contribution to the company is recorded can have a massive effect on tax liability. A good bookkeeper can also locate missing accounts receivable, or locate credit balances with vendors. There's so much more to it than entering transactions from the bank feed.

Hiring a bookkeeper is one of the most important decisions you will make for your business. Be sure to take your time and be intentional in your search.

If all taxes were abolished tomorrow, you would still need a bookkeeper.

If the world hit a big reset button tomorrow and taxes were simultaneously, globally eradicated, a lot of professions would go away. There would be no tax preparers, of course, but also significantly reduced need for financial advisors (why bother with tax shelters?), and payroll companies (can't I just hand my employees whatever I'd like to pay them?).

But you would still need a bookkeeper.

You would still need to track not only your income and expenses, but also who owed you money, and to whom you owed money. You would still have loans to track, and need to break out the amortized interest from the repayments. You would still need to know how much your assets were worth, and how much your company as a whole was worth.

There are so many things a good bookkeeper can do for you that are relevant not only at tax time, but throughout the year and over the whole life of your business.

Take some time, away from tax season, to take a look at your financials and discuss them with your bookkeeping professional. Getting the best possible tax return is important, but there's so much more you can be using your financial data for.

Staying (Financially) Fit Over the Holidays

With Halloween only 12 days away, we are officially in the holiday season. This is my favorite time of year, and I understand the temptation to let work slide as I give into the distraction of Thanksgiving, Christmas, and vacation.

But holiday season coincides with year-end and, for businesses, this needs to be a time of focus. Just as it's easy to undo months of dedicated diet and exercise with the wild abandon of the holidays, it's easy to let your business financials slip at the time when you really need them at their peak.

Here are a few common bookkeeping issues we see in Q4 year after year, and how to avoid them.

Missing Deductible Expenses

The holidays are a great time to let loose and be more sociable with co-workers, clients, and referral partners. But just as you lose count of how many calories you're taking in, you can lose track of the money you're spending. Not only can this result in overspending, of course, but you can also be missing out on deductible expenses that will save you money in just a few months at tax time.

The holidays are a great time to let loose and be more sociable with co-workers, clients, and referral partners. But just as you lose count of how many calories you're taking in, you can lose track of the money you're spending. Not only can this result in overspending, of course, but you can also be missing out on deductible expenses that will save you money in just a few months at tax time.

Perhaps you're planning an office Christmas party for your staff. Not only would those expenses be deductible, even food purchased for a potluck, but any staff appreciation gifts you'd like to hand out, as well. The same goes for client or vendor appreciation gifts. (If you have someone external doing your books, be sure they're asking about purchases for things like massage gift cards and fruit baskets, and recording them as business expenses, not draw activity.)

Many networking groups hold a special holiday party. Not only would any food and drink you purchase for that be deductible, but also mileage to the event. If you're having trouble keeping up with your mileage, something as simple as a mileage log (free to download here) in your vehicle or as sophisticated as an app can do wonders to help you track that.

Whatever you do, be sure you're keeping proper record of your business expenses, even while you party it up.

Falling Behind on Bookkeeping

Between parties, travel, and employees being out sick from all the germs they picked up partying and travelling, it's easy for certain tasks to get a bit behind in the later part of the year. However, bookkeeping is not like cleaning the house; you can't just plan to catch it all up at once. If I don't clean my house for a month, it's not that much more difficult, proportionately, than if it's not cleaned for a week. Bookkeeping doesn't work that way. If your bookkeeping takes four hours a month and you fall three months' behind, you now have twelve hours worth of bookkeeping to do. (And finding twelve hours for a task you like is difficult enough; imagine trying to find half an entire day to dedicate to a task you dislike.)

Between parties, travel, and employees being out sick from all the germs they picked up partying and travelling, it's easy for certain tasks to get a bit behind in the later part of the year. However, bookkeeping is not like cleaning the house; you can't just plan to catch it all up at once. If I don't clean my house for a month, it's not that much more difficult, proportionately, than if it's not cleaned for a week. Bookkeeping doesn't work that way. If your bookkeeping takes four hours a month and you fall three months' behind, you now have twelve hours worth of bookkeeping to do. (And finding twelve hours for a task you like is difficult enough; imagine trying to find half an entire day to dedicate to a task you dislike.)

Many business owners who find themselves in the position of staring down months of untouched financials make the decision to get some outside help, just to catch things up. The problem is that they're in good company. Beginning in November, professional bookkeepers get very busy with new clients who are hoping to get their books cleaned up for year-end. Not only is there an influx of new clients, but existing clients continue to need service, and we're busy getting all of their year-end documents ready as well. Many of my friends who work solo or operate smaller firms do not take on any new work during this time of the year.

If you aren't certain that you'll be able to keep up with your financials on your own during the holiday season, begin seeking assistance now, before you get too busy.

Not Preparing for Next Year

(NOTE: If you are one of those people who files an extension out of habit, this is for you.)

You may not realize it, but there is a lot you can be doing right now to get ready for next year's tax season.

You may not realize it, but there is a lot you can be doing right now to get ready for next year's tax season.

Just like you don't have to wait to make a New Year's resolution to start getting fit, you don't have to wait for January 1st to start getting your books in shape for tax season. For starters, you can be preparing for the January payroll reporting rush. In the chaos of year-end, many business owners forget that 1099s and W-2s are due at the end of January, and not in April. To prepare, you can be sure that you have W-9s, W-4s, and any required state tax documents on hand now, instead of trying to get them from workers later. (This is especially true of 1099 contractors, as they may work for you for a much shorter season and can be harder to track down later.)

If you have been using an outsourced payroll system, be checking now to ensure that the payroll reports in your financials match those provided by the vendor. Sometimes errors do occur, and you will need to alert the payroll company right away if their totals are incorrect. (Like bookkeepers, they are getting very busy this time of year, too.)

You want to check to make sure that your sub-ledger totals, such as your Accounts Receivable and Accounts Payable, match your General Ledger balances. You also want to be sure that you are up-to-date on any reconciliations.

Finally, it's a good idea to take some additional tax-sheltering steps. For example, if you had a good year and are cash-basis, consider making a large business purchase in December instead of January, to reduce your taxable income. Or maybe you have not been paying enough into your withholdings or your quarterly estimated self-employment taxes, and need to increase those in December. There are many options available to you, but you need to act now.

Fortunately, you still have some time to make the most of your holiday season. Stay on top of your books as you go, and you will have a restful and relaxing January (at least compared to everyone who didn't put in the work during December). If you need help, we are always available.

Guest Post: "What Does Marketing Strategy Have to do with Bookkeeping?" by Haley Lynn Gray

I have run across more than a few small business owners - some doing okay for themselves, others not - who take the shotgun approach when it comes to marketing their business. The first key is when they tell me that they have “The Facebook”, and they’re doing “ads”, and they are doing a bit of this and a bit of that.

I know that they are likely trying everything they come across, with little regard for the strategy and overall marketing plan. It’s not that I don’t believe in being spontaneous, or even getting creative with part of your marketing. But the reality is that nearly every piece of your marketing should come together; it should all work together, sort of like an orchestra.

If you start running Facebook ads without a solid presence and good organic reach, the cost of your ads is going to be significantly higher, and the cost per client for acquisition is going to be dramatically higher. In some cases, I’ve seen the cost of a lead being 5-10 times the cost that it would be with a good organic strategy.

If you start running Facebook ads without a solid presence and good organic reach, the cost of your ads is going to be significantly higher, and the cost per client for acquisition is going to be dramatically higher. In some cases, I’ve seen the cost of a lead being 5-10 times the cost that it would be with a good organic strategy.

The same concept applies to Google Adwords. The lower your SEO ranking, and the less high quality content you have on your website, the higher your cost will be to advertise with Google Adwords.

I see people who toss up a landing page using Web.com, YP.com or others. Unfortunately, if you take this approach, you might be building links to a website that isn’t your own. It won’t help you get that organic reach for your website and you’re losing control of the process. You’ll also end up spending more money for fewer leads, and thus end up with fewer results.

It’s important to have a strategy with all the pieces coming together. Sometimes the tweaks can be tiny, like adding a clear call to action on every blog post, or making a point of collecting email addresses so that you can stay in touch with people via email campaigns. It takes strategy and planning to collect those email addresses and to execute a well thought-out marketing campaign. By thinking through how all of the pieces should work, and with help from a strategist if you need one, you can end up saving a lot of money.

It’s important to have a strategy with all the pieces coming together. Sometimes the tweaks can be tiny, like adding a clear call to action on every blog post, or making a point of collecting email addresses so that you can stay in touch with people via email campaigns. It takes strategy and planning to collect those email addresses and to execute a well thought-out marketing campaign. By thinking through how all of the pieces should work, and with help from a strategist if you need one, you can end up saving a lot of money.

Every business needs a strategy and a budget. So does a marketing plan. Everything should be measured, and data should be collected on how your system is performing so that it can be tweaked and improved. Do these steps for every aspect of your business and you will see savings and a healthier bottom line.

Haley Lynn Gray is CEO and Founder of Leadership Girl, a digital marketing agency, where she uses her skills as a sales and marketing strategist and social media expert to help small business owners grow their business.She combines her years of real-life and business experiences with her MBA from Duke’s Fuqua School of Business to benefit her clients. Haley works with them closely to set goals and put processes in place so they can achieve and exceed their goals.

Haley, along with her team, can also help with social media management, website updates, drip campaign management, and all aspects of business marketing.

In addition to running her business, Haley is a mom of four, a Girl Scout Leader and an author of two best-selling books. Haley is truly passionate about helping entrepreneurs achieve their potential, and empowers them to overcome obstacles in entrepreneurial ventures. www.leadershipgirl.com

Your Accountant's Weird Habits - Explained

If you have a pet in your family, maybe you've seen those articles purporting to explain why your dog spins in a circle before lying down, or why your cat would rather drink from the faucet than a water dish. To many people, there is a creature even more alien and perplexing than any animal: the finance professional.

Your bookkeeper or tax professional might say or do things that don't make a lot of sense to you. Some of their actions might seem flat-out contradictory. But, as with any exotic species, there is a reason behind all of it.

I want to break down a few of the most commonly complained-about behaviors, along with the explanations behind them (with the assistance of cat pictures).

First annoying habit: My accountant keeps nagging me to get organized.

Your bookkeeper wants you to have a system for tracking open customer balances, or wants you to keep all your expense reports in one place. It's frustrating, because the whole reason you're paying them is for them to "keep up with that stuff".

So why do they do it?

For starters, good bookkeeping relies on complete information. (A balance sheet showing $1M in the bank doesn't mean much if there's a $995K liability that got left off.) Unless you have an in-house accounting staff, your bookkeeper is relying on you to get that information to them. A good organizational system ensures that all of the information is getting to who needs it.

Furthermore, most accountants charge based on time expended, and though good accounting can be had at a good value, it's still not cheap. Paying your accounting service to dig through files and hunt down info is a waste of their time and your money.

Speaking of "time", my accountant freaks out if I don't get certain information to them right away. What's the rush?

Certain items, particularly related to tax filings, can incur massive penalties if late. Your accountant needs the information in advance of those deadlines, to record it and check for accuracy. (Inaccurate filings can also, of course, result in penalties.)

If your accountant is pestering you to get information to them quickly, it's because they are trying to keep you out of trouble and save you money.

Since we're already talking about taxes...Why does my accountant try to make me spend money I don't want to spend? For instance, why do I have to treat certain workers as W-2 employees, instead of paying them as contractors?

Because worker classification is a big deal. Not paying employees correctly can result in audits, fines, and even lawsuits. Your accountant is being a stickler about the rules because they don't want you to get sued.

Still talking taxes...Why does my accountant say I can't take this cool deduction I found? I saw online that I can expense my home office/car payment/pet kinkajou/etc.

Present blog excluded, internet advice is no substitute for real, professional guidance. Though you'll seeing many articles claiming that you can write off an entire car payment, or take a "home office" deduction, the actual guidelines surrounding those items have specific criteria which must be met. Unfortunately, small businesses, particularly those which are sole proprietorships, are frequent targets for audits. Taking excessive, unqualified deductions puts you at an even greater risk. If you trust your tax professional, trust that they will advise you of deductions for which you do qualify. (If you are not happy with your current tax professional, we can recommend some.)

So I have to spend extra on employees, but can't take any of the fun deductions. And now I'm being told that I need to watch my spending on meals, and look at ROI for things like advertising. Is my bookkeeper just a kill-joy?

No, they just don't want you to go broke. Going bankrupt isn't just bad for you; it also means you can't pay your vendors (like your bookkeeper). So they have a vested interest in keeping you solvent.

Because, no matter what your business, one thing we all have in common is that we like to get paid.

Pricing Strategies: How do I know how much to charge?

To view this article in video form, visit our YouTube channel.

One of the hardest decisions a new business owner makes is how much to charge. In calculating the "right" price, there are a number of variables to consider.

For starters, let's re-visit Intro to Microeconomics and ask, is your product elastic, or inelastic? Elastic products are those goods or services in which demand is closely tied with price. In other words, demand on an elastic product will increase with a decrease in price, and vice versa. The demand for inelastic goods is steadier, and less dependent on price.

For starters, let's re-visit Intro to Microeconomics and ask, is your product elastic, or inelastic? Elastic products are those goods or services in which demand is closely tied with price. In other words, demand on an elastic product will increase with a decrease in price, and vice versa. The demand for inelastic goods is steadier, and less dependent on price.

For example, a specific brand of chocolate chips is a highly elastic good. If the price increases too much, customers will just purchase a different brand of chocolate chip (or decide to bake a different type of cookies, or just buy the pre-made cookies outright). Though I might really like Ghirardelli brand chocolate chips, I don't really need them, and there are plenty of ready substitutes available.

A very inelastic product would be gasoline. The price tends to be relatively uniform within a geographic area, and most people are heavily reliant on it in their day-to-day lives. Even when the price surges, consumers still have to purchase a certain amount. Likewise, even when gasoline is very cheap, people don't necessarily start driving and purchasing significantly more.

If your product is elastic, you don't necessarily have to have one set price. You could employ "surge" pricing, a la Uber, and charge more when your goods or services are in greater demand. You can also try to generate increased demand through temporary price drops. (Perhaps some of you are old enough to remember "blue light specials".) If you want to keep steady prices, or if you're good is inelastic, there are other variables to consider.

To develop a pricing strategy, you should know your variable expenses, how to calculate profit margin, and have a general idea of market price (competitors' prices).

Maybe you have a surface familiarity with the terms "variable expenses" and "profit margin", but aren't 100% clear on how they're calculated. For your benefit, we'll have a quick accounting lesson.

Variable expenses are those expenses which are directly tied to the production of each unit of a product, and might include such expenses as raw materials, labor hours, and shipping costs. In other words, variable expenses increase (or vary) as production increases. Costs of Goods Sold (or COGS) are variable expenses.

Variable expenses are those expenses which are directly tied to the production of each unit of a product, and might include such expenses as raw materials, labor hours, and shipping costs. In other words, variable expenses increase (or vary) as production increases. Costs of Goods Sold (or COGS) are variable expenses.

To calculate your profit margins, divide your net profit (sales - COGS) by your sales. Playing with these formulas at different prices can help you determine a feasible price for your product.

As far as competitive pricing, it is good to be in a range with your market competitors, though you don't necessarily have to be the cheapest, or even on the lowest end. Trying to win customers on price alone can cause a big hit to your profit margins, and will not bring you long-term success. If you cannot safely price your competitors out, beat them with a distinguished product and superior customer service.

Finally, there are discounts to consider, particularly "friends and family" pricing. Special pricing is fine, as long as you can still maintain healthy margins. Never sell at a loss, even for those close to you. You do not want to have to raise prices on friends and family later, so set them at a level you can maintain indefinitely. If you price yourself out of business, you really aren't doing your loved ones any favors.