Guest Post: Neal Isaacs, "Advice on Accountants (for what it's worth)"

Today's guest post is from Neal Isaacs. Neal Isaacs, MBA, CBI is a Business Broker and the owner of VR Business Brokers of the Triangle, located in Raleigh, NC. He writes about business and helps business owners discover their exit options. Call (919) 628-0571 or email [email protected] for your free consultation. Learn more at http://www.vrbiztriangle.com/.

Today's guest post is from Neal Isaacs. Neal Isaacs, MBA, CBI is a Business Broker and the owner of VR Business Brokers of the Triangle, located in Raleigh, NC. He writes about business and helps business owners discover their exit options. Call (919) 628-0571 or email [email protected] for your free consultation. Learn more at http://www.vrbiztriangle.com/.

As a business broker, I answer a lot of questions about how to sell a business. One of my FAQs that I share with all business owners planning to sell is about the total cost to sell a business.

People don’t think about costs in selling a business. The first question people always think is “How much can I get?” but the truth is:

It’s not how much you make, but how much you keep that matters.

So how much will you keep? What will be left depends on how much it costs to sell a business, as well as your tax treatment on what you get. Costs to sell a business, if you don’t consider paying off your debts, are primarily professional fees. Consider the investment in a business broker, as most business sellers are doing it for the first time, and the sale of a business is a complicated and convoluted transaction, and consider the costs of a business attorney.

sell a business, if you don’t consider paying off your debts, are primarily professional fees. Consider the investment in a business broker, as most business sellers are doing it for the first time, and the sale of a business is a complicated and convoluted transaction, and consider the costs of a business attorney.

You’ll also want to consider the costs of a accountant. Chances are sellers are already using these advisors, but there may be some additional costs for updating or adjusting P&L statements.

Depending on your time frame for the sale of your business, there may be more that can be done from an accounting perspective to increase the value of your business from a buyer’s perspective. Let’s consider:

How Far?

The “look-back” period for the sale of a business is normally three years, but some buyers will ask for five. If you’re planning to sell your business in the next couple of years, it’s wise to communicate this fact to your accountant, and to start working with a business broker. Preparing and highlighting the best financial aspects of your business is something a good business broker can help you with in conjunction with your accountant.

The fact of the matter is, running a business to sell is different than running a business to support a lifestyle. The IRS has a lot of rules that your accountant will know and guide you on regarding how much you’ll have to pay in taxes, but a good accountant will also know how to protect you from paying too much tax in a legal and ethical manner.

How Much?

It may sound obvious, but don’t be afraid to ask an accountant how much they charge, or at least to give you a range of what to expect. Different accountants charge different prices for similar work because they have different costs to run their businesses, and they bring different experience to each opportunity, so interview your prospective accountant to learn if they are bringing the right skill and experiential sets that you need.

Do We Fit?

When picking an accountant, it’s good to ask them about what their client base looks like. You’re accountant will know exactly how much money you have, and the size of your business eventually, so consider being up front with them in your first meeting if for no other reason than to ask them if your business resembles their current book of business. If your business is an outlier, they may simply not be reviewing the tax code and regulations related to the needs of your business.

Too Much?

I have seen one person pay $400/hour for financial due diligence on a deal for buyer representation, and it was way too much. The CPA on the buyer’s side was more than willing to ask questions and go down paths that were not germane to the deal at hand, in part because he was being paid by the hour, and in part because his client hired him to investigate, and he was used to investigating very complicated businesses. This was not a complicated business, and in my opinion this buyer brought a cannon to a knife fight (and paid for it).

Whether you’re a buyer or a seller, picking the right accountant, or even upgrading to the right accountant, can pay for itself. Especially after the sale, when you have to deal with the financial repercussions of capital gains (this is another great question to ask your accountant early if you’re a seller).

If you need help choosing or interviewing an accountant in preparing for the sale of your business, I can help. Email me at [email protected] and I’m happy to share some questions that you could ask an accountant that you’re considering hiring.

What to Look for in Hiring a Bookkeeper

As your business grows, you will reach a point where you need to seriously consider hiring a bookkeeper. Unfortunately, bookkeeping is still a very un-regulated industry. Anyone can market his or herself as a bookkeeper, and it can be very difficult to sort the wheat from the chaff.

Obviously, your needs will be very specific to your company. However, there are a few basic things you can look out for to help you make the best decision in hiring a bookkeeper.

Look for certifications AND references.

Some people are very good at test-taking, and can certifications easily in an afternoon. (For instance, some lower-level QuickBooks certifications can be very easy to obtain with a minimal amount of studying.) But if they are difficult to work with, or don't do a great job of taking care of clients' books, they will likely not have many positive references available.

Some bookkeepers are very social and, at least on the surface, can impress clients. (Or, at the very least, they're good at getting friends and family to provide them with references.) However, if they do not have the accounting knowledge and technical skills necessary, they won't be good bookkeepers.

When seeking help, prioritize bookkeepers who have both certifications and a significant amount of references. Beyond client reviews, also look for reviews from partnering businesses, such as CPA firms. A good CPA appreciates working on financials that have been prepared by a good bookkeeper.

You can also ask your potential bookkeeper for references from current or prior clients in a business similar to yours.

Check their business registration.

Most legitimate bookkeeping firms will have officially registered their company. Depending on their state of registry, you can look up such information as how they are structured, how long they have been in business, their company officers, whether they have every faced dissolution, etc. (In North Carolina, where we're based, you can check the Secretary of State website for business registrations.)

There's nothing wrong with hiring a newer company, but you might want to consider a bookkeeping firm which has been in business for a few years, first. You can also look at things like whether they have a physical office space, or if the company ownership has changed hands multiple times. (And if they have been administratively dissolved in the past, consider it a major red flag.)

Heed the red flags.

There's a great quote from the show Bojack Horseman which goes, "When you look at someone through rose-colored glasses, all the red flags just look like flags."

Considering the high importance of your bookkeeping being done accurately, you do not want to ignore any red flags in your search for a bookkeeper. Being slow to respond, having little web presence, or being too eager to jump into working with you can all be red flags. If they are setting off your alarm bells during the initial search, consider how much worse things can become once you have hired them.

Ask about their experience with companies like yours, and with services you might need (such as their systems for managing payroll, sales tax, etc.). Ask about their policies on client communication, and how they prioritize time-sensitive tasks. Most importantly, particularly if they are a 1-person shop, ask about their plans for who can back them up on your account in the event of an emergency, where they might be unexpectedly unavailable.

Make sure THEY ask YOU good questions.

A few months ago, we met a prospective client for a free 1-hour consultation. She was upfront about the fact that she had scheduled interviews with other bookkeepers, and would be following up with us later. A few weeks later she let me know she would like to hire us. Her reason for choosing us, over other companies was, "You actually asked me questions and looked at my system. You were the only one who did that."

Be leery of a bookkeeper who swears they can handle your business financials without first establishing exactly what that entails. Not every client is a good fit for every bookkeeper (and vice versa). We maintain friendly relationships with our local competitors, so we have a good alternative to offer when we meet with a prospect and realize they would not be a good fit for us. Likewise, our competition sends us referrals, as well.

In your initial meeting with your potential bookkeeper, make sure they are trying to learn about your business, and not just sell you on theirs.

Find someone who understands accounting beyond record-keeping.

There is a misconception that a great bookkeeper is just someone with exceptional data entry and organizational skills. However, there is a lot that a real bookkeeper can do to help save money on taxes, identify areas of risk, or even improve profitability. Something as simple as how an owner's cash contribution to the company is recorded can have a massive effect on tax liability. A good bookkeeper can also locate missing accounts receivable, or locate credit balances with vendors. There's so much more to it than entering transactions from the bank feed.

Hiring a bookkeeper is one of the most important decisions you will make for your business. Be sure to take your time and be intentional in your search.

If all taxes were abolished tomorrow, you would still need a bookkeeper.

If the world hit a big reset button tomorrow and taxes were simultaneously, globally eradicated, a lot of professions would go away. There would be no tax preparers, of course, but also significantly reduced need for financial advisors (why bother with tax shelters?), and payroll companies (can't I just hand my employees whatever I'd like to pay them?).

But you would still need a bookkeeper.

You would still need to track not only your income and expenses, but also who owed you money, and to whom you owed money. You would still have loans to track, and need to break out the amortized interest from the repayments. You would still need to know how much your assets were worth, and how much your company as a whole was worth.

There are so many things a good bookkeeper can do for you that are relevant not only at tax time, but throughout the year and over the whole life of your business.

Take some time, away from tax season, to take a look at your financials and discuss them with your bookkeeping professional. Getting the best possible tax return is important, but there's so much more you can be using your financial data for.

2018 Tax Changes (Explained as Best as Humanly Possible)

To put it very (very) mildly, the new tax bill is not without its problems. In their newsletter attempting to explain the new bill's changes, the American Institute for Public Bookkeepers (AIPB) wrote, "Warning: You are encouraged to wait, where possible, for IRS guidance to confirm the details below. There are many technical errors in this tax law."

We have tried our best to explain how a few of these various changes might affect your business. In the interest of keeping this an article and not a book, we'll be summarizing many of the details, with links to articles where each piece can be expanded upon in greater depth.

To begin, here are a few of the easiest changes.

Mileage rates. The standard business mileage deduction has been raised from 53.5 cents per mile to 54.5 cents per mile.

Listed property. Computers and peripherals are no longer listed property, and therefore do not have to be held to the same proof of exclusive business-use standards as, for example, vehicles.

Meals & Entertainment. From 2018 through 2025, on-premise meals for employees will be reduced from 100% deductible to 50% deductible. As of 2026, they will no longer be deductible at all. Most entertainment expenses are no longer deductible.

Getting a bit more in-depth...

Income from pass-through entities. Anything other than a C-Corp is now considered a pass-through entity (including S-Corps). Pass-through deductions on individual returns are also significantly changed, particularly for those higher-income earners in the fields of law, accounting, medicine, consulting, athletics, financial services, and brokerage services. More details can be found here, Can You Win From the Pass-Through Deduction?, and more details on other lines of businesses to be affected will hopefully be explained by new IRS amendments and regulations.

C-Corp income. You may already be aware that taxes for C-Corps have been significantly reduced, to a flat 21%. However, the deduction for dividends received from other corporations has also been reduced from 70% to 50% for most dividends, and to 65% for those dividends which had been previously deducted at 80%.

Depreciation changes. This is another area that has received a lot of coverage, as the changes here are extensive. For starters, tangible personal property has been expanded to include property primarily used to furnish lodgings and improvements to nonresidential real estate. (If you're in the hotel business, this should be very exciting news for you.) Furthermore, Section 179 and bonus depreciation have been increased, with new rules not only applying to 2018, but also to property purchased in 4th quarter 2017, or purchased before 4th quarter 2017 but not put into use until 2018. Unfortunately, most of the bonuses expire in five years. Forbes has a great write-up of these changes, Tax Geek Tuesday: Changes To Depreciation In The New Tax Law.

Business interest expense and income. The business interest deduction is now capped at 30% of income (excluding depreciation) and can be carried forward for five years. Small businesses are exempt if they have less than $25 million in annual gross receipts, or are cash-basis. It also does not apply to "any taxpayer in the business of being an employee" (IRS clarifications hopefully coming soon), or to real property/real estate businesses. Business interest income also no longer includes interest from investments.

And the information we either don't have, or which is too long to list here.

FITW. For starters, federal income tax withholding tables are not yet available, but are scheduled for this month, to be used for employee wages as early as February. These could mean for some significant changes in employee take-home pay, but we won't know exact details until they are released by the IRS. This can be a bit of a headache for small businesses handling their own payroll; if you are not currently using a payroll service provider, now might be a good time to research those options.

Fringe benefits. Many fringe benefits which previously counted as deductions for employers will now no longer be deductible. Additionally, certain expenses are no longer deductible for employees, as well (in particular, un-reimbursed business expenses). See The New GOP Bill and What It Means for Employee Benefits in 2018 for a list of the eliminated benefits.

With all of the changes to tax law in 2018, it's dangerous to try and navigate on your own. Talk to your accounting professional about how these changes will affect your business.

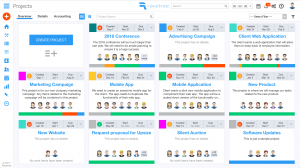

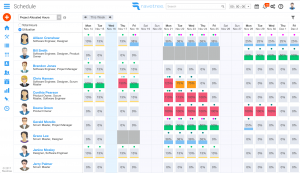

Feature Spotlight: Davidson Wicker, CEO of Ravetree

As those of you who have known us over the last few years are aware, The Bookkeeper grew quickly. When new employees were brought on board, it became obvious that our old, piecemeal system of digital file storage in one location, a time tracking app in another, and endless emails detailing project updates, would not be sufficient as we scaled.

We were fortunate to come across Ravetree in its early days, and to have the opportunity to adopt it to our business. It has been a true "game-changer" for us, and has really allowed us to stay on top of all of our client and operational needs, even during rapid expansion.

I got to ask Ravetree CEO Davidson Wicker a few questions about himself, his company, and their product.

Courtney: I saw that your educational background is in Applied Physics. How did you transition that into a career in software development?

Davidson: I taught physics for a couple of years as I was building up my coding skills. We did some scientific programming in grad school, so that's where I started to get a taste of how fun programming could be.

Staying (Financially) Fit Over the Holidays

With Halloween only 12 days away, we are officially in the holiday season. This is my favorite time of year, and I understand the temptation to let work slide as I give into the distraction of Thanksgiving, Christmas, and vacation.

But holiday season coincides with year-end and, for businesses, this needs to be a time of focus. Just as it's easy to undo months of dedicated diet and exercise with the wild abandon of the holidays, it's easy to let your business financials slip at the time when you really need them at their peak.

Here are a few common bookkeeping issues we see in Q4 year after year, and how to avoid them.

Missing Deductible Expenses

The holidays are a great time to let loose and be more sociable with co-workers, clients, and referral partners. But just as you lose count of how many calories you're taking in, you can lose track of the money you're spending. Not only can this result in overspending, of course, but you can also be missing out on deductible expenses that will save you money in just a few months at tax time.

The holidays are a great time to let loose and be more sociable with co-workers, clients, and referral partners. But just as you lose count of how many calories you're taking in, you can lose track of the money you're spending. Not only can this result in overspending, of course, but you can also be missing out on deductible expenses that will save you money in just a few months at tax time.

Perhaps you're planning an office Christmas party for your staff. Not only would those expenses be deductible, even food purchased for a potluck, but any staff appreciation gifts you'd like to hand out, as well. The same goes for client or vendor appreciation gifts. (If you have someone external doing your books, be sure they're asking about purchases for things like massage gift cards and fruit baskets, and recording them as business expenses, not draw activity.)

Many networking groups hold a special holiday party. Not only would any food and drink you purchase for that be deductible, but also mileage to the event. If you're having trouble keeping up with your mileage, something as simple as a mileage log (free to download here) in your vehicle or as sophisticated as an app can do wonders to help you track that.

Whatever you do, be sure you're keeping proper record of your business expenses, even while you party it up.

Falling Behind on Bookkeeping

Between parties, travel, and employees being out sick from all the germs they picked up partying and travelling, it's easy for certain tasks to get a bit behind in the later part of the year. However, bookkeeping is not like cleaning the house; you can't just plan to catch it all up at once. If I don't clean my house for a month, it's not that much more difficult, proportionately, than if it's not cleaned for a week. Bookkeeping doesn't work that way. If your bookkeeping takes four hours a month and you fall three months' behind, you now have twelve hours worth of bookkeeping to do. (And finding twelve hours for a task you like is difficult enough; imagine trying to find half an entire day to dedicate to a task you dislike.)

Between parties, travel, and employees being out sick from all the germs they picked up partying and travelling, it's easy for certain tasks to get a bit behind in the later part of the year. However, bookkeeping is not like cleaning the house; you can't just plan to catch it all up at once. If I don't clean my house for a month, it's not that much more difficult, proportionately, than if it's not cleaned for a week. Bookkeeping doesn't work that way. If your bookkeeping takes four hours a month and you fall three months' behind, you now have twelve hours worth of bookkeeping to do. (And finding twelve hours for a task you like is difficult enough; imagine trying to find half an entire day to dedicate to a task you dislike.)

Many business owners who find themselves in the position of staring down months of untouched financials make the decision to get some outside help, just to catch things up. The problem is that they're in good company. Beginning in November, professional bookkeepers get very busy with new clients who are hoping to get their books cleaned up for year-end. Not only is there an influx of new clients, but existing clients continue to need service, and we're busy getting all of their year-end documents ready as well. Many of my friends who work solo or operate smaller firms do not take on any new work during this time of the year.

If you aren't certain that you'll be able to keep up with your financials on your own during the holiday season, begin seeking assistance now, before you get too busy.

Not Preparing for Next Year

(NOTE: If you are one of those people who files an extension out of habit, this is for you.)

You may not realize it, but there is a lot you can be doing right now to get ready for next year's tax season.

You may not realize it, but there is a lot you can be doing right now to get ready for next year's tax season.

Just like you don't have to wait to make a New Year's resolution to start getting fit, you don't have to wait for January 1st to start getting your books in shape for tax season. For starters, you can be preparing for the January payroll reporting rush. In the chaos of year-end, many business owners forget that 1099s and W-2s are due at the end of January, and not in April. To prepare, you can be sure that you have W-9s, W-4s, and any required state tax documents on hand now, instead of trying to get them from workers later. (This is especially true of 1099 contractors, as they may work for you for a much shorter season and can be harder to track down later.)

If you have been using an outsourced payroll system, be checking now to ensure that the payroll reports in your financials match those provided by the vendor. Sometimes errors do occur, and you will need to alert the payroll company right away if their totals are incorrect. (Like bookkeepers, they are getting very busy this time of year, too.)

You want to check to make sure that your sub-ledger totals, such as your Accounts Receivable and Accounts Payable, match your General Ledger balances. You also want to be sure that you are up-to-date on any reconciliations.

Finally, it's a good idea to take some additional tax-sheltering steps. For example, if you had a good year and are cash-basis, consider making a large business purchase in December instead of January, to reduce your taxable income. Or maybe you have not been paying enough into your withholdings or your quarterly estimated self-employment taxes, and need to increase those in December. There are many options available to you, but you need to act now.

Fortunately, you still have some time to make the most of your holiday season. Stay on top of your books as you go, and you will have a restful and relaxing January (at least compared to everyone who didn't put in the work during December). If you need help, we are always available.

Why "Cheap & Easy" Online Bookkeeping Services are Neither

Online "full-service" bookkeeping companies have been on my mind a lot lately. Mostly, it's because we've recently had to do so much clean-up work for clients who have previously used these services to keep their books.

Over the past week alone, we've started working with three different clients who previously employed three different online accounting services. All three have told us, separately, how the solution that was supposed to save them money and make their life easier ended up costing them hundreds or thousands of dollars for incomplete, inaccurate financials.

So, if bookkeeping is really just a matter of putting the right numbers in the right spots, how is it that these companies are falling so short of the mark? Let's look at a comparison of how an internet bookkeeping company works versus how we work.

Utilizing technology vs. relying on technology.

Utilizing technology vs. relying on technology.

I won't be a hypocrite; I love technology, and we use it at The Bookkeeper to make our work faster and more accurate. (We even have clients in other areas of the country, with whom we've never met in person.) However, trusting technology to make the correct judgment calls, without checking behind it, leads to errors. Online bookkeeping services enter transactions based on vendor defaults; for example, this can lead to a $10,000 bank transfer being labelled as a "bank service charge", because the bank is listed as the vendor in the downloaded transaction description, and that's where it defaults. An expert familiar with the account is going to be well aware that the $10,000 is not a service fee, and will assign the transaction appropriately. And speaking of experts...

Hiring the best people vs. hiring the most people.

Hiring the best people vs. hiring the most people.

One of the things I am most proud of in the growth of my company is the team we've assembled. We have some very experienced people, and everyone is focused on constant education and improvement. We offer better benefits than our direct competitors, and do a lot to ensure that our employees have a clear path to growth within the company.

When I first started seeing the product being put out by these online bookkeeping companies, I was curious about what it must be like to work there. I went to Glassdoor and read some reviews by current and former employees, which confirmed a lot of my suspicions. Even the positive reviews spoke of their company as a "great stepping stone" to employment in a more traditional firm. Several employees spoke of it being their first job after graduation. I'm glad that there are good employment opportunities for young bookkeepers, but I don't feel that I would want them to be the point person responsible for a client account.

Inclusive service vs. charging for "add-ons".

Possibly due to the fact that their employees have less experience, online bookkeeping services do not offer full bookkeeping to the degree that a traditional company would. Most do not allow for entering invoices, bills, line of credit, fixed assets, nor payroll; if they do offer these services, it is at steep surcharges. (One company offers payroll for up to only three employees for $100 a month!) We recognize that things like bill-pay, tracking receivables, filing sales, recording depreciation, etc. are all necessary for truly accurate financials, and should be included as a part of the original agreed-upon rate, without being snuck in as a costly "add-on". Speaking of pricing...

Charging for the work done, instead of how much you think the client can afford.

Charging for the work done, instead of how much you think the client can afford.

I am always suspicious of companies which offer pricing based on monthly expenses or revenues in dollar amounts. Here's a secret: larger companies aren't always more work. Imagine a client who is a business broker; this client might make $20,000 in one month, but it might be on only one sale! Now imagine a client who is a dry cleaner; the dry cleaner might make less than half of that, but it could be in hundreds of transactions. Which one do you think takes more time for the bookkeeper to enter? One transaction, or hundreds?

Businesses who charge based on amount of money passing through the client's account are often just trying to see how much they can get away with charging. They know that a client who only spends a few thousand dollars a month will not want to see a large proportion of their budget go to a $450/month online bookkeeping solution. Likewise, they know that a client spending $100,000 a month will not notice that amount to the same extent. It is, in my opinion, a deceptive marketing practice.

Proactive vs. reactive service.

Most online bookkeeping companies ask clients to submit bank statements at month-end, and then just download the transactions into the system at that time. As we've discussed before, we get into client accounts, at minimum, twice a week, to help monitor cash flows, identify potential problem areas, and review areas of improvement. This allows for timely and therefore relevant information, as well as allowing us to compile period-end financials much more quickly, since most of the work is already done by the time the month closes.

This is not to say that online bookkeeping services can't be helpful in select situations. If a client has a high number of very basic transactions, with no fixed assets nor liabilities, and no interest in tracking invoices nor bills, no payroll, and no sales tax, an online solution might be more cost-effective for them. However, I would highly encourage anyone else to get a second consult before signing an agreement with an online-only bookkeeping company.

Local Entrepreneur Spotlight: An Interview with Dave Baldwin of Baldwin Management Consultants

Courtney recently sat down with Dave Baldwin, of Baldwin Management Consultants, in Raleigh. From his website: "Dave Baldwin is an experienced marketer and self-taught entrepreneur who first went into business for himself in 2007 after ten years in the technical field, spurred on by a desire to help introverted entrepreneurs succeed in business. Dave has worked with clients in a variety of different industries."

Courtney recently sat down with Dave Baldwin, of Baldwin Management Consultants, in Raleigh. From his website: "Dave Baldwin is an experienced marketer and self-taught entrepreneur who first went into business for himself in 2007 after ten years in the technical field, spurred on by a desire to help introverted entrepreneurs succeed in business. Dave has worked with clients in a variety of different industries."

Courtney: I can't start without asking about "Let's Not Have Coffee". Why do you think that piece has become so popular so quickly?

My other skill set is marketing copywriting, which is mostly a matter of speaking the customer's language. That's not easy, but I've developed some simple methods for uncovering what's important to customers. It starts with asking the right questions, and I've been told I have a gift for that. Being a consultant is not about telling someone what to do. It's about helping a client create a solution that they feel good about. Most people already have most of the knowledge they need to solve their own problems, but they just haven't looked at their situation from the right vantage point. A good marketing message should help them see things in a new way.

In addition to being an established local entrepreneur, Dave is one of the breakout speakers at the upcoming Triangle Small Business Summit, sponsored by Affordable Promos and The Bookkeeper. Dave will be speaking on Using Technology and Automation to Grow Your Small Business.

When you're hungry, E.A.T.

Every small business has, or should have a marketing strategy. If, like us, you sell to other businesses instead of directly to consumers, referrals are likely a huge part of that strategy.

I have seen small business owners put a lot of effort into obtaining referrals: they join networking groups, visit socials, and schedule 1-on-1s with various referral partners (or potential referral partners).

However, many business owners neglect to put any thought into their best potential referral source: current clients.

Now, asking a client for referrals is a delicate science. (After all, you've already asked for and obtained their business; it can feel presumptuous to ask for even more on top of that.) But if you are strategic, while continuing to put the client first, current clients can be an incredible pipeline for new business.

If you are hungry for new business, remember the acronym "EAT".

"E"arn

This shouldn't need to be clarified but, in order to get referrals, you need to earn referrals. If someone is giving you a referral, they are sticking their neck out for you because, if you do a bad job, it reflects poorly on them.

This is especially true for clients, who should know better than anyone what level of quality service you provide. And if they are not completely happy with your service, pushing for a referral they don't feel you've earned may actually cause them to reevaluate their relationship with you.

"A"sk

Asking for referrals can be awkward, but if you have a client who is thrilled with your services and is already telling you they're happy, it is reasonable to transition to a request for referrals at that time. It also never hurts to have a bonus for referrals, whether that's a discount, cash bonus, or a discounted rate for the client they're recommending. (Note: Some businesses can't receive cash gifts, but might still appreciate a gift basket or being taken out for a meal.)

Beyond asking the right way, you need to be thoughtful in your timing of asking clients for referrals. Don't ask for referrals right at the beginning of an engagement, as they have not yet had accurate time to reflect on your service. Also don't ask for referrals if the client is in the middle of a crisis you're helping to solve; their minds are not in the place to think of anyone who could use your business, and it is a bit manipulative to put that pressure on them when they are already stressed out.

"T"each

If your clients are very happy with you, they might want to send you referrals, but just don't know how. This can especially be true if your business is one that many people don't understand, or if you work with a wide variety of clients.

For instance, many of our clients and referral partners don't initially realize that, though we mostly work with established companies, we also work with very small and new start-ups. Once they found that out, several of my business friends told me, "I have someone who needs your help." The issue wasn't with a lack of referrals, but with a lack of education coming from me.

Keep your clients up-to-date on what you're working on, without being intrusive, and they will likely think differently about how they can refer business to you.

Guest Post: "What Does Marketing Strategy Have to do with Bookkeeping?" by Haley Lynn Gray

I have run across more than a few small business owners - some doing okay for themselves, others not - who take the shotgun approach when it comes to marketing their business. The first key is when they tell me that they have “The Facebook”, and they’re doing “ads”, and they are doing a bit of this and a bit of that.

I know that they are likely trying everything they come across, with little regard for the strategy and overall marketing plan. It’s not that I don’t believe in being spontaneous, or even getting creative with part of your marketing. But the reality is that nearly every piece of your marketing should come together; it should all work together, sort of like an orchestra.

If you start running Facebook ads without a solid presence and good organic reach, the cost of your ads is going to be significantly higher, and the cost per client for acquisition is going to be dramatically higher. In some cases, I’ve seen the cost of a lead being 5-10 times the cost that it would be with a good organic strategy.

If you start running Facebook ads without a solid presence and good organic reach, the cost of your ads is going to be significantly higher, and the cost per client for acquisition is going to be dramatically higher. In some cases, I’ve seen the cost of a lead being 5-10 times the cost that it would be with a good organic strategy.

The same concept applies to Google Adwords. The lower your SEO ranking, and the less high quality content you have on your website, the higher your cost will be to advertise with Google Adwords.

I see people who toss up a landing page using Web.com, YP.com or others. Unfortunately, if you take this approach, you might be building links to a website that isn’t your own. It won’t help you get that organic reach for your website and you’re losing control of the process. You’ll also end up spending more money for fewer leads, and thus end up with fewer results.

It’s important to have a strategy with all the pieces coming together. Sometimes the tweaks can be tiny, like adding a clear call to action on every blog post, or making a point of collecting email addresses so that you can stay in touch with people via email campaigns. It takes strategy and planning to collect those email addresses and to execute a well thought-out marketing campaign. By thinking through how all of the pieces should work, and with help from a strategist if you need one, you can end up saving a lot of money.

It’s important to have a strategy with all the pieces coming together. Sometimes the tweaks can be tiny, like adding a clear call to action on every blog post, or making a point of collecting email addresses so that you can stay in touch with people via email campaigns. It takes strategy and planning to collect those email addresses and to execute a well thought-out marketing campaign. By thinking through how all of the pieces should work, and with help from a strategist if you need one, you can end up saving a lot of money.

Every business needs a strategy and a budget. So does a marketing plan. Everything should be measured, and data should be collected on how your system is performing so that it can be tweaked and improved. Do these steps for every aspect of your business and you will see savings and a healthier bottom line.

Haley Lynn Gray is CEO and Founder of Leadership Girl, a digital marketing agency, where she uses her skills as a sales and marketing strategist and social media expert to help small business owners grow their business.She combines her years of real-life and business experiences with her MBA from Duke’s Fuqua School of Business to benefit her clients. Haley works with them closely to set goals and put processes in place so they can achieve and exceed their goals.

Haley, along with her team, can also help with social media management, website updates, drip campaign management, and all aspects of business marketing.

In addition to running her business, Haley is a mom of four, a Girl Scout Leader and an author of two best-selling books. Haley is truly passionate about helping entrepreneurs achieve their potential, and empowers them to overcome obstacles in entrepreneurial ventures. www.leadershipgirl.com